-

Quick View

-

Quick View

-

Quick View

-

Quick View

-

Add to cartQuick View

-

Add to cartQuick View

-

Select optionsQuick View

-

Select optionsQuick View

-

Select optionsQuick View

-

Add to cartQuick View

-

Add to cartQuick View

-

Add to cartQuick View

-

Select optionsQuick View

-

Add to cartQuick View

-

Read moreQuick View

-

Read moreQuick View

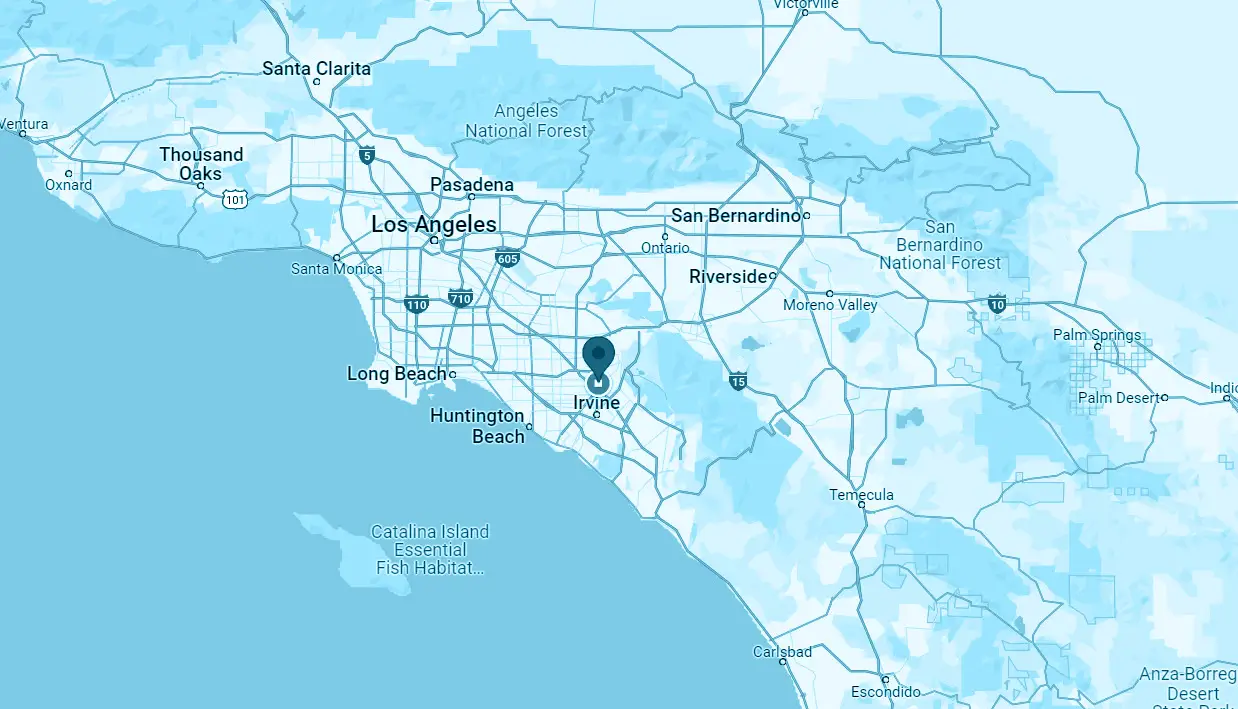

17821 E 17th St

Ste 180

Tustin, CA 92780

*Opt-in / Opt-out

**Customers provide their phone number and consent to receive messages via a form on our website